Salvage value formula

Retail value of the motor vehicle by checking YES or NO to the question. 9 interest compounded semi-annually.

How To Determine An Asset S Salvage Value

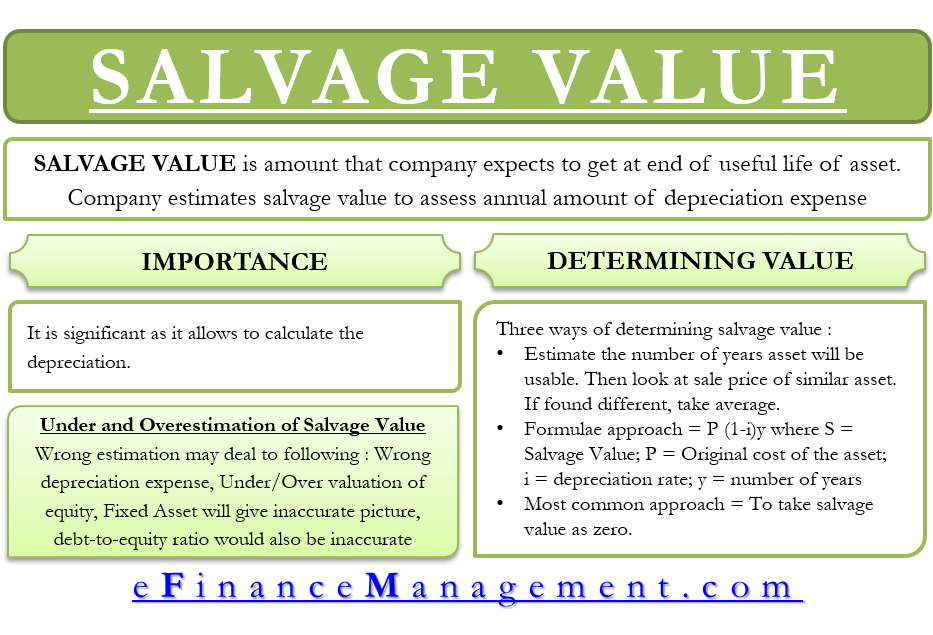

The salvage value of an asset is the.

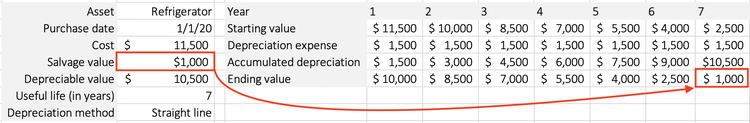

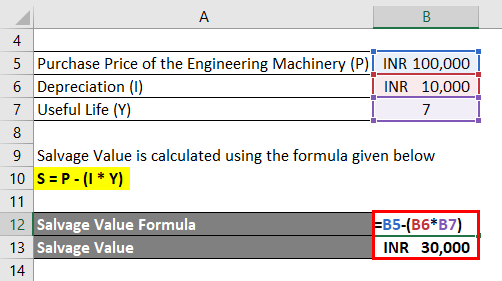

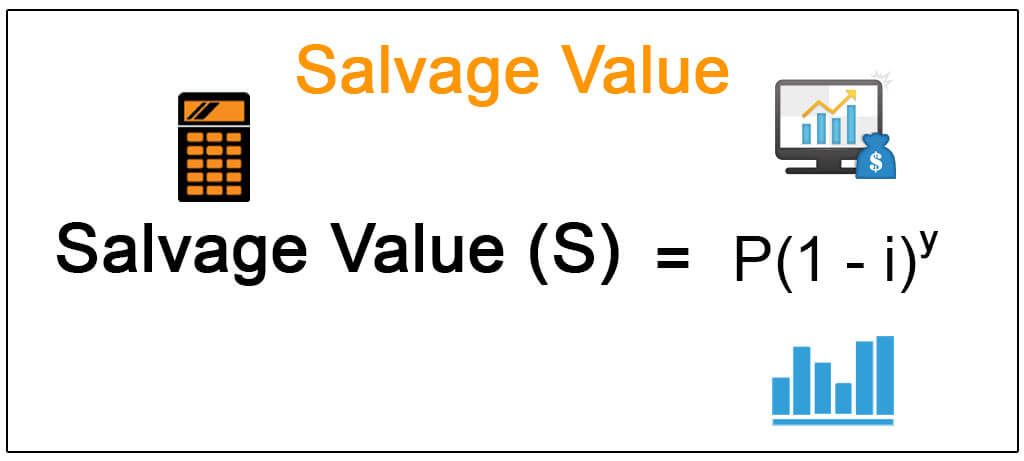

. Subtract salvage value from the original cost. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method. Determine the salvage value of the asset Salvage Value Of The Asset Salvage value or scrap value is the estimated value of an asset after its useful life is over.

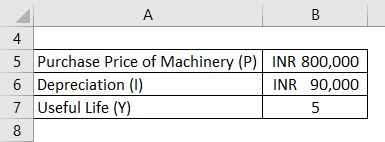

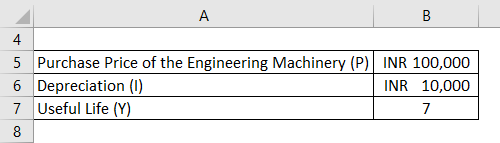

Lets assume that the company. The salvage value is Rs. The salvage value formula requires information like purchase price of the machinery depreciation amount mode of depreciation expected life of the machinery etc.

Accumulated depreciation here means total depreciation charged or accumulated by the company on its assets till the date of calculating the net book value of the asset. Company X considers depreciation expenses for the nearest whole month. Useful life 5.

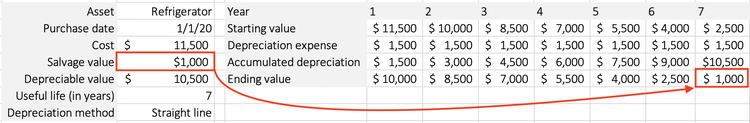

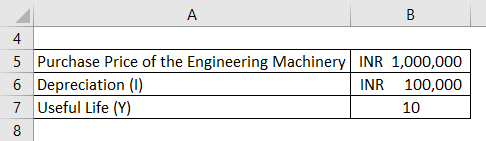

Salvage value is the amount for which the asset can be sold at the end of its useful life. Original Purchase cost here means the purchase price of the asset paid at the time when the company purchased the assets. To get the actual value of the scrap or the salvage amount of the machinery.

Salvage value is the estimated value that the owner is paid when the item is sold at the end of its useful life. Knowing the salvage value of the asset youre evaluating is essential to calculating the total accumulated depreciation for the year using the straight-line method. See NDCC 39-05-172 for further information on calculating the Assessed Damage of a vehicle.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. Use the following guide to calculate accumulated depreciation with the straight-line formula. Straight line depreciation percent 15 02 or 20 per year.

Maturity Value Formula Example 2 Continuing the above example you have 10000 to invest for 5 years and now you have arranged a quotation from 3 different financial institutions. This is expected to have 5 useful life years. Determine the initial cost of the asset at the time of purchasing.

Read more ie the. For example if a construction company can sell an inoperable crane for parts at a price of 5000 that. Net Book Value Calculation Example.

Sometimes due to better than expected efficiency level the machine tends to operate smoothly in spite of. The value is used to determine annual depreciation in the accounting records and. The amount of damage to a motor vehicle is determined by adding the retail value of all labor parts and materials used in repairing the damage.

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula And Example Calculation Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

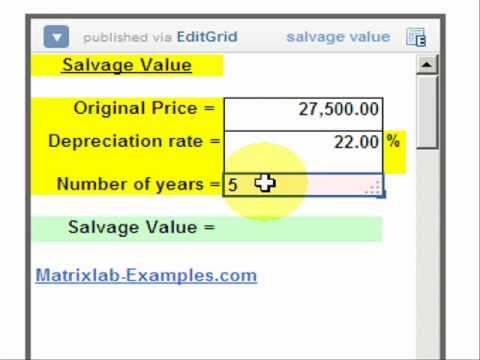

Salvage Value Calculation Youtube

7 Of 14 Ch 10 After Tax Salvage Value Atsv Calculation Youtube

Salvage Value Meaning Importance How To Calculate

Salvage Value Formula Calculator Excel Template

Salvage Value A Complete Guide For Businesses

Salvage Value Formula Calculator Excel Template

Salvage Value Formula And Example Calculation Excel Template

After Tax Salvage Value What Is The Definition And Formula How To Calculate Youtube

Salvage Value Calculation Youtube

Depreciation Formula Calculate Depreciation Expense

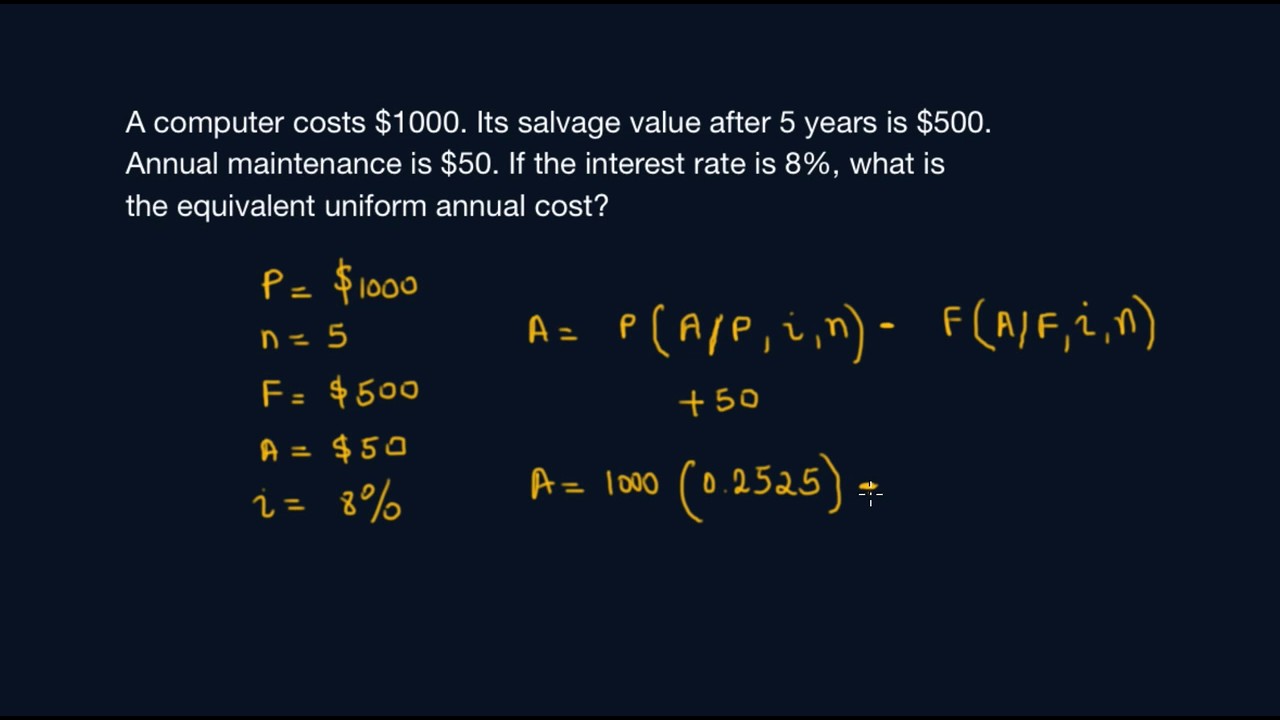

Calculating Annual Cost With Salvage Value Youtube